Multiply the budgeted variable cost allocation rate by the actual usage. Here s a two step process to calculate the dual rate cost allocation of the it department.

1 1 Chapter 6 Allocating Costs Of A Supporting Department To

1 1 Chapter 6 Allocating Costs Of A Supporting Department To

Fixed costs and variable costs.

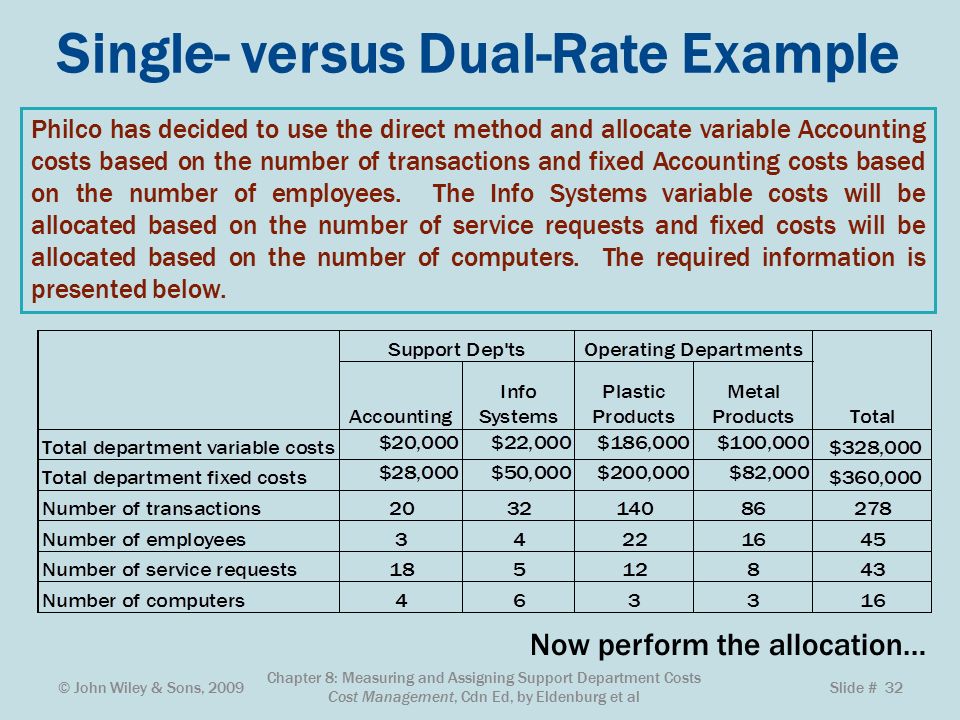

Dual rate cost allocation method. In cost accounting the single rate cost allocation method uses one cost rate to dictate the dollars that are allocated from a cost pool to a unit batch department or division. In addition a technique referred to as the dual rate or flexible budget method is presented to show how fixed and variable service department costs can be allocated separately. Multiply the budgeted fixed cost allocation rate by the budgeted usage.

Are used for allocation. In the case of support departments the rate allocates dollars to another department or division. This allows a more specific review of costs and leads to more precise cost allocations.

This section compares dual rate and single rate methods and illustrates how spending and idle capacity variances can be calculated for service departments. 15 2 the dual rate method provides information to division managers about cost behavior. Variable cost pool and fixed cost pool each have their own appropriate cost allocation rate.

The dual rate method refers to a situation in which one rate is used to allocate the fixed costs of a support department while a different rate is used to allocate the variable costs of a support. If a dual rate cost allocation method is used what amount of copying facility costs will be allocated to the operations department. The benefit of the dual rate charging method of cost allocation is.

However note that the milk chocolate division is allocated 16 000 in fixed trucking costs however note that the milk chocolate division is allocated 16 000 in fixed trucking costs under the dual rate system compared to 800 15 actual trips 12 000 when actual trips. Assume budgeted usage is used to allocate fixed copying costs and actual usage is used to allocate variable copying costs. A that it is similar to a plantwide overhead rate where all support department costs are accumulated in the numerator and some measure of usage is in the denominator.

B that it makes supporting departments responsible for their usage and helps to prevent overuse of resources. Dual rate cost allocation method categorizes cost into two types of cost pools. The dual rate cost allocation method classifies costs in each cost pool into a.

The dual rate cost allocation method classifies costs in each cost pool into two pools a variable cost pool and a fixed cost pool with each pool using a different cost allocation base. A budgeted cost pool and an actual cost pool b variable cost pool and a fixed cost pool c direct cost pool and an indirect cost pool d direct cost pool and a reciprocal cost pool.

-

Some pronouns are singular and others are plural. Plural pronouns are simply pronouns that refer to plural nouns. Singular And Plural Pro...

-

When you first begin to examine a spark plug check for any black soot on the insulator or even the central electrode. Any soot or carbon bu...

-

At the end of the year every person that earned income must file a tax return to determine whether the government collected enough taxes th...

Featured Post

foods cats can eat

What Can Cats Eat? 36 Human Foods Cats Can Eat All. . Web Cats can eat all types of boneless meat and filleted fish in small amounts....

ads